The MIT study is out! The good news is more and more investors care about where there money is going.

The study reveals a “growing number of investors are paying attention to ESG performance, as evidence mounts that sustainability-related activities are material to the financial success of a company over time. Investors care more about sustainability issues than many executives believe”.

It also states “managers’ perceptions of investors are out of date”. For those who are listening to public sentiment there is movement afoot. Sustainable and impact funds are on the rise. This is based on empirical data and has been a part of conversations among the elite impact community for years, so it’s about time.

When looking at the brick and mortar world of investment banking, mutual fund and financial instruments, we are seeing green and humanitarian funds pop up such as Morgan Stanley’s Parity Fund with our favorite expert on women Eve Ellis, their Institute for Sustainable Investing, offerings from JP Morgan and others like Black Rock are investing billions.

The Little Rock Accord that was signed in 2012 , long before the Paris climate talks reflecting a commitment of 5% of pension and institutional investments going to impact. That’s a whopping $800 billion per year! This is no small potato – the tide is turning to use money as a force for good.

And this is turning out to be good business. Looking at Bloomberg’s New Energy Finance study, 2.3 trillion dollars and that’s only 1% of the US marketplace. The “future’s so bright, gotta wear shades”.

MIT STUDY ON SUSTAINABLE INVESTING

Download the Full Report (PDF) *Registration Required

The research and analysis for this report was conducted under the direction of the authors as part of an MIT Sloan Management Review research initiative in collaboration with and sponsored by The Boston Consulting Group.

Favorite results from the study showing why sustainability is important for making investment decisions and where companies align:

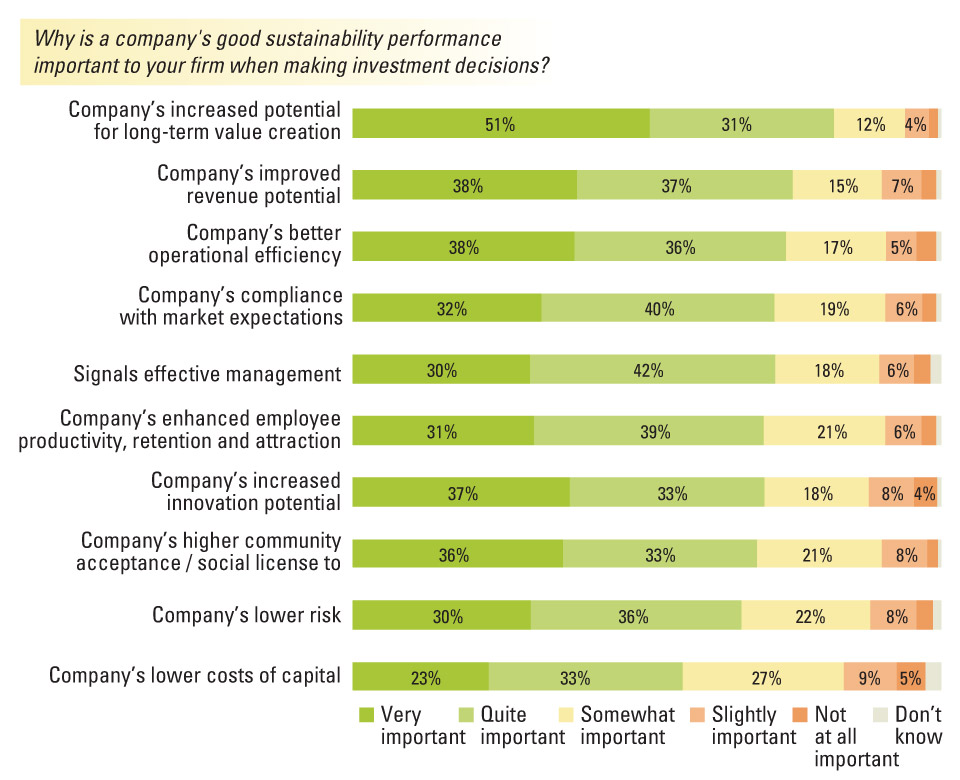

Investors Care About Good Sustainability Performance for Many Reasons. Investors recognize that good sustainability performance is a source of many types of business value. The top three are: increased potential for long-term value creation, improved revenue potential, and operational efficiency

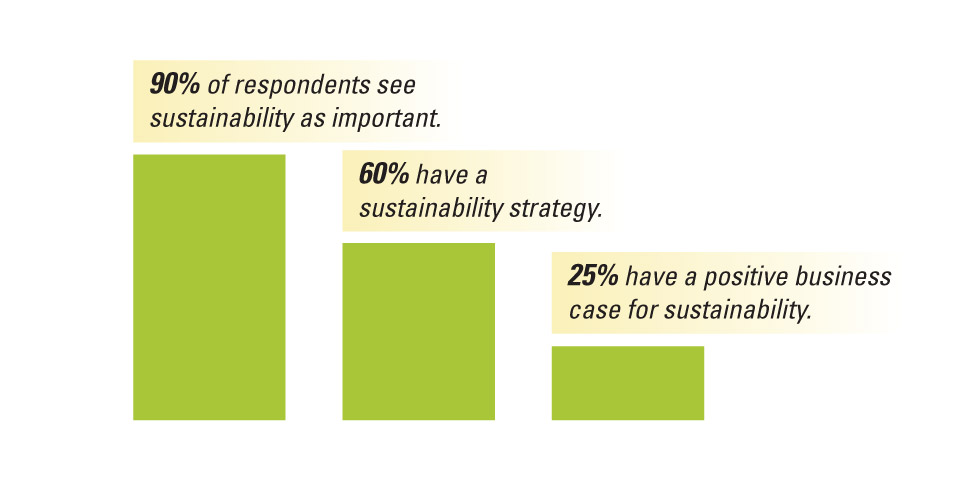

Many Companies Still Struggling to Define a Business Case for Sustainability. While almost all respondents consider sustainability activities as critical to future competitiveness, only 60% have a strategy, and one-quarter have managed to develop a positive business case.

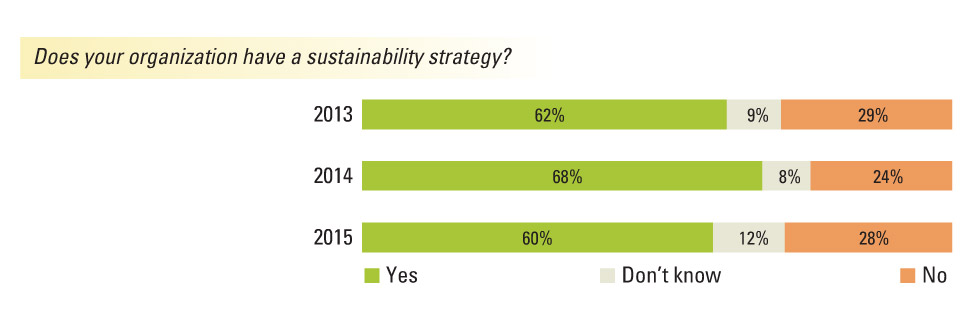

Fewer Companies Have a Sustainability Strategy Today. A majority of respondents indicate that their companies have a sustainability strategy, but the majority is slightly smaller than in previous years.

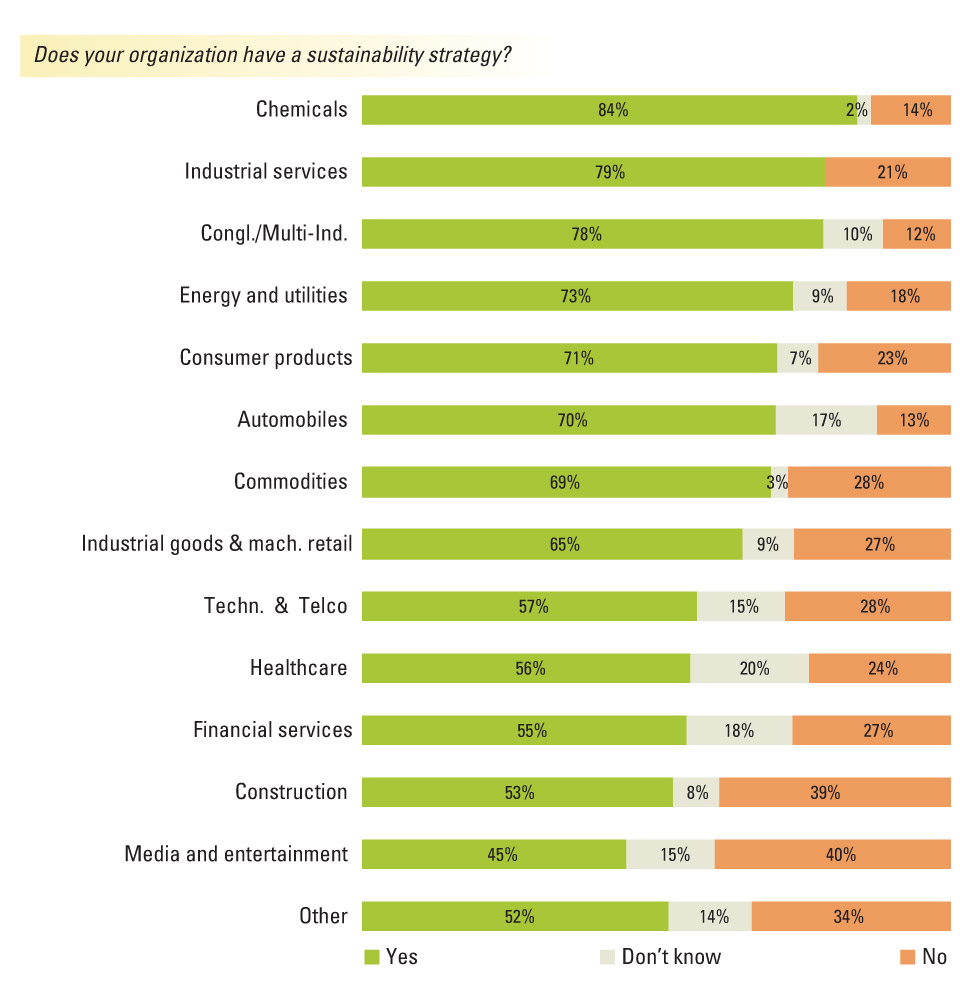

Figure 7: Sustainability Strategies Are More Prevalent in Some Industries. Chemicals, industrial services, and conglomerates have the highest concentration of companies with sustainability strategies. As in past years, the media and entertainment industry has the lowest percent of companies with a sustainability strategy.

___________________________________________

LEARN MORE

* Excerpts republished from MIT. To read the entire summary, visit MIT’s site to see the Sloan Study where you can download the official packet

Follow us Twitter.com/NobleProfit

Like us on Facebook.com/NobleProfit

Register at NobleProfit.com to gain valuable insights in related topics.

Noble Profit is brought to you by Creative Entity Org and Creative Entity Productions created by Amy Seidman.

Noble Profit™ is an authentic source for discovering innovation, trends and investment in clean tech, and sustainable business.

Noble Profit™ is an authentic source for discovering innovation, trends and investment in clean tech, and sustainable business.