You feel it – your portfolio can be a tool for good. But how do you measure it?

How can you quantify the human, social and environmental impacts of your portfolio – cash, fixed income, equities, venture investing, commodities – and allocate more dollars to sustainable investments? Are positive impacts and attractive financial returns possible at the same time?

Yes, positive human impact and profit are possible and emerging as the “new fundamentals” of investing, starting with investment policy.

Quantifiable Impact Added to Investment Policy Statements

Leading investors (and advisors) are incorporating a new factor – impact – into their investment policy statements alongside risk, return and liquidity. These investors – entrepreneurs, families and foundations, pension funds – seek specific measures of how their portfolios are “doing good” and how that can drive “making money.”

While Warren Buffett and Bill Gates are asking the wealthy to donate at least half of their fortunes to charity in the Giving Pledge, sustainably oriented investors are targeting all their investments to work for positive impact. Some are publicly stating their Investing Pledge, committing to “100 percent sustainably invested portfolios by 2020.” To see who’s committing, or to join go to http://www.hipinvestor.com

Quantifying “human impact + profit” is possible. Being “HIP” (for its acronym) demonstrates that leading indicators of profit include human, social and environmental performance.

“People are our organization’s most important asset.” How many times have you heard a CEO espouse this?

Yet, where are people accounted for on the company’s financial statements? On income statements, people are expenses, and not portrayed as revenue generators, the human source of that innovation. People-related costs are mainly characterized on the balance sheet as “liabilities” for future pension and health-care obligations. While people create products, our accounting systems and analysts do not normally classify them as assets (which can appreciate), but as costs. There is a systemic “gap” in GAAP (generally accepted accounting principles).

Infosys, the global technology company based in India, has pioneered reporting people as assets. Infosys’s “human resource valuation” counts each employee according to how they add value (e.g. technologists, customer service) and assigns revenue generation to each role, leading to a truer return-on-assets ratio. While spreading in India, financial reports from Europe or US-based firms lack this approach. Forward-looking investors evaluate this core driver of value and how it can benefit their portfolio.

Professor Alex Edmans of the Wharton School has shown that from 1998 to 2009 a portfolio of Fortune magazine’s “Best Companies to Work for” (e.g. higher employee satisfaction and staff diversity) tends to have higher financial returns than the overall stock market.

While traditional investors and analysts ignore core factors that drive financial results – including human, social and environmental performance metrics, HIP Investor’s methodology systematically tracks these factors and incorporates them in the HIP 100 Index (see the latest performance at http://www.hipinvestor.com ).

Measuring Results, Not Policies, of Your Portfolio

Impact investing embraces these fundamentals: value comes from cultivating top talent to innovate; resiliency results from engaging diverse stakeholders to manage risk and tap new ideas; and natural-resource efficiency uses less energy and water while de-materializing the products and operations of the business. Sustainability results can be measured quantitatively.

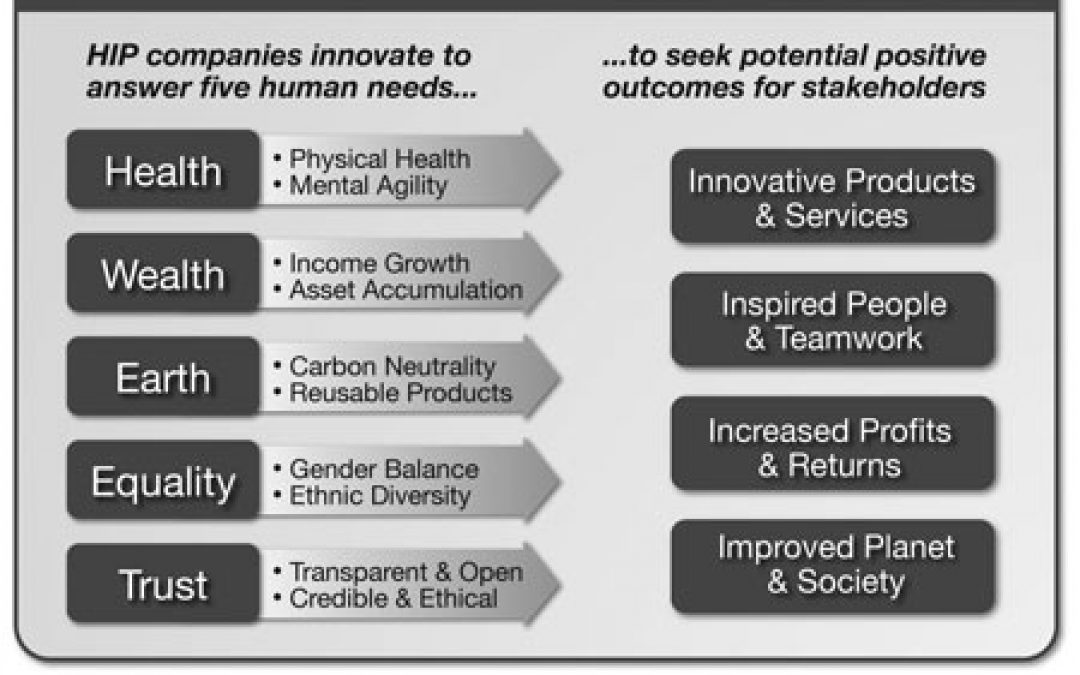

The HIP Scorecard analyzes 30 metrics across five categories inspired by Maslow’s hierarchy of needs: Health, Wealth, Earth, Equality and Trust. Each category maps to a specific business result, from innovative products to inspired people to (potentially) increased profits and a more improved planet. [See Chart] More details on these metrics can be found in my recent book, The HIP Investor: Make Bigger Profits by Building a Better World (Wiley, 2010).

While companies are increasingly reporting a range of sustainability results, from staff diversity to water usage, investors can source data from the government (OSHA, EPA), nonprofits and academia.

Version 1.0 of socially responsible investing looked at policy manuals, but companies like BP excelled at words rather than actions. While BP was a solar-power leader in the 1990s, the Gulf of Mexico oil-gusher in 2010 was a result of terrible safety performance (860 violations over 3 years), which ultimately led to lax operational discipline and an environmental disaster that killed 11 people and seriously injured another seven.

Version 2.0, frequently called “sustainable” or “impact” investing, systematically tracks measurable results and how they can drive bottom-line value. Executives and Boards at companies who value people, engage stakeholders, and address their environmental impact incorporate these factors into a comprehensive, long-term, life-cycle approach and management discipline. HIP’s methodology also rates how companies integrate five dimensions – vision, metrics, financial alignment, accountability and decision-making – into strategic direction, capital allocation, and staff performance reviews.

The HIP Scorecard also quantifies revenue generated from positive-impact products. One example is Campbell’s Soup numerically categorizing its revenue by “milligrams of sodium per serving” per product. For fiscal year 2010, Campbell’s targeted 30 percent of its revenue from “lower sodium” products (480 mg/serving or less). As of the 2009/10 Sustainability Report, “wellness” and “heart healthy” products earned 26.8 percent of revenue. VP of Sustainability Dave Stangis works closely with CEO Doug Conant and Investor Relations to ensure that financial analysts understand how this benefits society and the financials.

These three categories – Products and Services; Operating Metrics; and Management Practices – are blended together into a company HIP Score. A firm’s score fluctuates yearly based on its sustainability results. HIP then can weight investor portfolios according to HIP Scores, including our HIP 100 Index, which has outperformed the benchmark since its inception on 7/30/2009 through 12/31/2010 (see http://www.hipinvestor.com for details and disclosures). Future HIP indexes, such as an international equities version, are forthcoming.

Scoring Every Asset Class of Your Portfolio

Every aspect of your portfolio can be evaluated on its human, social and environmental impact – as well as its profit characteristics, such as risk, return and liquidity. An overall portfolio can have a weighted-average “HIP Score” quantifying “human impact + profit” and weighted by the amount invested in each security or asset class.

Each aspect of an investment portfolio can be rated: where you park your cash, how you generate fixed income from bonds (corporate, municipals); allocations to equities, domestic and global; venture capital and private equity; and alternatives and commodities.

For example, New Resource Bank accepts deposits that it then lends out for renewable power and energy efficiency – a very HIP approach. In municipal bonds, funds are invested in positive-impact infrastructure such as schools, hospitals and public transportation – which perform well on a HIP scale. In equities and corporate debt, whether public or private, each company can be rated on overall sustainability performance. Hedge funds, which are not very open about what they do and how they do it, are typically not very HIP, and are usually quite illiquid, restricting divestment. With the advent of ETFs (exchange-traded funds) that mimic traditional hedge-fund strategies at lower costs and fees, some investors are gaining more flexibility. Investors using highly capital-efficient investment vehicles – e.g. microfinance guarantees, which insure loan losses with no current use of capital – can boost a portfolio’s impact.

By rating your portfolio, you can find your baseline score. To raise your score, consider shifting the asset mix. Examine sustainable private companies, which can rate higher, and consider revenue-backed municipal bonds. A tool like the “HIP Check,” a simplified scorecard co-created by HIP and impact investor Meyer Family Enterprises, rates new investments in three aspects: How HIP is it? Are the business fundamentals strong? How does it fit the portfolio mix? (To request a free copy of the HIP Check – email [email protected] )

Over the last quarter-century, the socially responsible investment market has grown to over $3 trillion, according to the Social Investment Forum, with more than 200 mutual funds and ETFs publicly offered. Many of these have pursued a “negative screening” approach and some have not kept up with the financial performance of their benchmark.

Over the next decade, we see a proliferation of “positive criteria” impact-investment strategies across all asset classes: from cash and fixed income to venture and commodities, as well as equities and bonds. JPMorgan recently released an “impact investing” report estimating $1 trillion of capital could fit this theme, including affordable housing and microfinance. Innovators like Portfolio 21, Generation Investment Management and even Goldman Sachs’ Sustain portfolios, as well as the HIP 100, are integrating a more comprehensive view of risk, return, liquidity and impact – and have generated solid performance. As the “new fundamentals of investing” demonstrate how sustainability can drive profits, shareholder value and competitive advantage, we can expect more investment products across all asset classes and more investors seeking impact.

How Can You Be a Leading Impact Investor – and More HIP?

- Integrate “impact” as a fundamental criterion in your portfolio.

- Measure that impact now and over time – discover your HIP Score.

- Seek out sustainable investments in all asset classes of your portfolio, including your bank – use the HIP Check.

- Allocate funds to investments that deliver quantifiable impact and profit.

- Make it public by making the Investing Pledge.

Are you 100 percent sustainably invested? Can you commit to be there by 2020 or sooner? Vote with all your money – how you spend and how you invest. In summary, you are hereby invited to be more HIP.

____________________

R. Paul Herman is CEO and founder of HIP Investor Inc. Herman is the author of “The HIP Investor: Make Bigger Profits by Building a Better World, published by John Wiley & Sons in 2010. Herman is a registered representative of HIP Investor Inc., an investment adviser registered in California, Washington and Illinois, and serving clients in Idaho, New York and Wisconsin.

NOTE: This is not an offer of securities nor a solicitation. The information presented is for information and education purposes, and does NOT imply any investment recommendations. Past performance is not indicative of future results. All investing risks loss of principal. The author, HIP Investor Inc. and HIP’s clients may invest in the securities mentioned above, including in the HIP Portfolios. Details and full disclosures are at www.HIPinvestor.com

Photography courtesy of HIP Investor, reprinted with article http://www.greenmoneyjournal.com/summer-2011/measuring-human-impact-profit-the-new-fundamentals-of-investing/ from GreenMoney.

___________________________

Follow us Twitter.com/NobleProfit

Register at Noble Profit to gain valuable insights in related topics.

Noble Profit is brought to you by Creative Entity Org and Creative Entity Productions created by Amy Seidman.

Noble Profit™ is an authentic source for discovering innovation, trends and investment in clean tech, and sustainable business.

Noble Profit™ is an authentic source for discovering innovation, trends and investment in clean tech, and sustainable business.